The launch of ChatGPT in late November and Apple’s (AAPL) release of the iPhone 14 was certainly a watershed event in artificial intelligence (AI). Allowing millions of people to get first-hand experience with the benefits of AI, ChatGPT owner OpenAI predicts $200 million in revenue at the end of 2023.

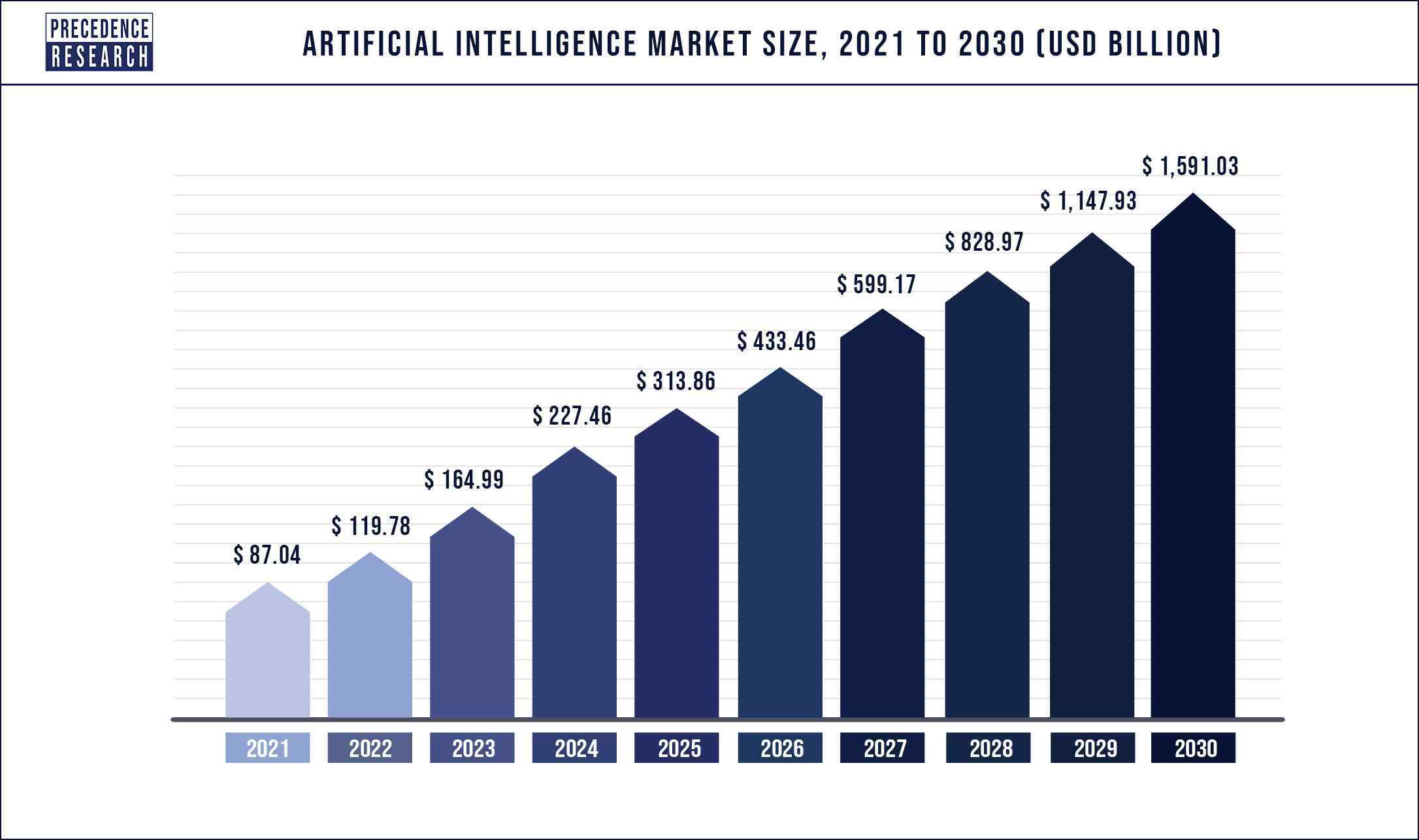

The global artificial intelligence (AI) market size was estimated at $119.78 billion in 2022 and is expected to reach $1.591 trillion by 2030 with a registered compound annual growth rate (CAGR) of 38.1% from 2022 to 2030.

The AI market is expected to rise by more than 13% over the next two years, as 97 million people will be working in the AI space by 2025.

(The Evolving Landscape of the Artificial Intelligence Market: 2021 to 2030)

Source: Precedence Research

Investing in AI stocks is one of the best ways for investors to tap the significant potential of this transformative technology. Companies use AI to improve their operations and to offer new products and services. AI stocks provide an opportunity for both beginner and seasoned investor to participate in the high-growth and innovative industry while potentially achieving attractive returns over the long term.

Here are some top AI stocks that provide good opportunities for investment:

C3 AI

C3 AI is a leading enterprise AI software provider that rides the wave of growth forecasted for AI. It has accelerated digital transformation and offered comprehensive services to build scalable AI applications more efficiently and cost-effectively than alternative approaches. It saw 20.1% CAGR to reach $387 billion in 2022, and it’s forecasted to increase to over $1.3 trillion by 2029.

C3AI is estimated to gain 27% in the coming days as the company has planned the release of its C3 Generative AI for Enterprise Search as part of its C3 Generative AI Product Suite.

Nvidia (NVDA)

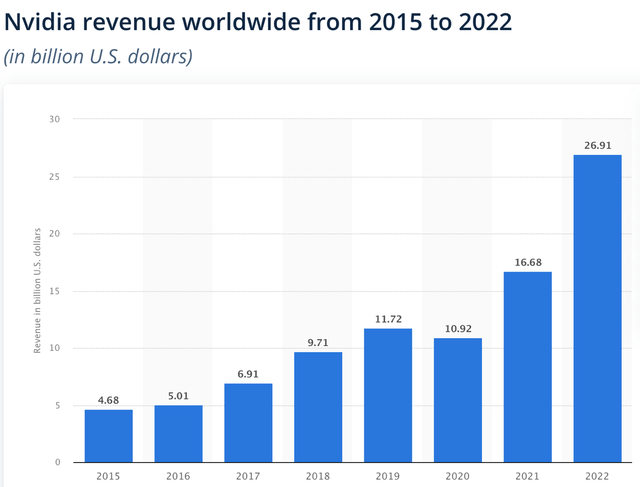

AI boom has benefited the market leading manufacturer of graphics chips, Nvidia, by uplifting its graphics card to become de facto norm data centres all over the world. Although not exclusively tied to AI, the industry is propelling the company’s expansion, as data centre operations continuously grow its revenue for the company. Advanced AI applications require a lot of computing power which Nvidia believes to have already seen its peak demand.

(Global Nvidia Revenue: A Trend Analysis from 2015 to 2022)

Source: Statista

The Nvidia stock rally has made Jensen Huang, founder and CEO considerably richer, as his net worth has grown by more than $5 billion so far this year. Analysis by Citigroup estimated that the boom in ChatGPT usage could translate to $3 billion to $11 billion in sales for Nvidia in the next 12 months as more people use ChatGPT, the more computing power OpenAI will need to process the responses of millions of users, and Nvidia is a dominant graphics and advanced computing technology.

IBM

Dominating the best hardware and software products, IBM is a leading American computer manufacturer with a major share of the market in the United States and abroad. The company aims to boost productivity, enhance human intellect and reduce expenses with the help of advanced AI strategy. IBM’s technology is being applied in the development of the healthcare sector by offering personalised care plans, new medications and enhancing the standard of care

With a rise of 6% in revenue in 2022, IBM generated $9.3 billion in free cash flow (FCF) and posted 15% growth in earnings per share. IBM’s revenue and earnings will rise by 1% to 6%, respectively according to analysis reports.

Oracle

Oracle assists businesses in automating operations through the use of prebuilt AI, data-driven cloud apps, and cost and time-saving workflows. The software giant has surpassed revenue and ESP (external service provider) estimated in the last quarter. The company’s ESP was 3.2% above the consensus estimate, while its revenue beat analyst estimates by 2.1 %.

The company is listed as #39 out of 138 stocks in the software application industry. Oracle expects its revenue to rise 17% to 19% on a reported basis and 21% to 23% on a constant currency basis in the third quarter. The stock has gained 19.5% in price over the past year (2022)to close the last trading session at $ 89.86 on 25th January 2023

Cyient

Cyient, an engineering, outsourcing, and technology solutions company offers AI tools and helps businesses to accomplish their corresponding objectives. The Hyderabad-based business company was ranked top 30 among outsourcing companies worldwide. Cyient’s financial performance and business has made 11 acquisitions and three investments since 2000, significantly accelerating its expansion. The company has spent more than $200M on the acquisitions, investing in multiple sectors such as OSS & BSS, Field Force Automation, Business Intelligence and more