The Federal Bureau of Investigation's Internet Crime Complaint Center (IC3) received over 800,944 complaints, resulting in cybercriminals targeting US networks, critical infrastructure, and national security, causing a 49% increase in financial losses, according to the Internet Crime Report. These incidents led to losses of over $10.3 billion.

Online banking facilitates, convenient handling of financial transactions, including bill payments, check deposits, and fund transfers, from any location. However, this convenience comes with an inherent risk of online scams and fraudulent activities. Cybercriminals constantly devise sophisticated methods to steal substantial sums of money through these scams. Therefore, safeguarding your online banking data assumes utmost importance.

A recent survey conducted in the United States revealed that digital banking services are preferred by an impressive 78% of Americans, surpassing the popularity of traditional banking methods. This data highlights a notable shift in consumer behavior, where an increasing number of individuals are choosing the convenience and accessibility offered by digital banking solutions.

The rise in fraudulent activities, with criminals stealing larger sums of money per fraud, has necessitated proactive measures to safeguard personal and financial information. Individuals need to take action to protect themselves from falling victim to these cybercrimes.

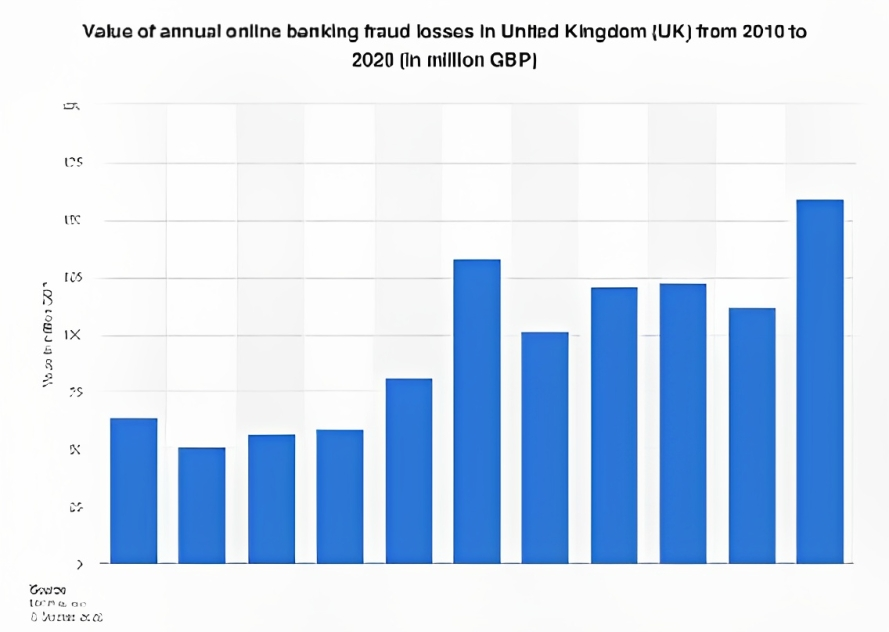

Annual Value of Online Banking Fraud in the United Kingdom (2010 – 2020)

(Source: - Statista)

With the growing dependence on digital technologies, cybercrimes have garnered significant attention in recent years, as criminals capitalize on the expansive possibilities afforded by the digital realm. Within the realm of cybercrimes, banking fraud has emerged as a particularly devastating threat, causing substantial financial losses. Regrettably, this alarming trend is projected to persist in the foreseeable future.

Secure Mobile Banking

Unfortunately, numerous individuals become victims of fraudulent activities on a daily basis. Without maintaining proper vigilance, it becomes effortless to fall prey to such scams.

Are you actively taking the necessary precautions to safeguard your personal and financial information?

BankQuality offers six invaluable recommendations to help you protect your online banking information and thwart unauthorized access to your personal and financial data by cybercriminals.

Lock it up: Create strong passwords

Your online banking password is at risk if you haven't created a strong and unique password.

When using online banking services, it is important to ensure that your login credentials are unique and secure. Tackers are constantly trying to steal your personal information, and your online banking password is one of the most valuable things they can get.

Here are 5 easy steps to create a strong and unique password that will protect your money:

Double Up Your Security: Use Two-factor authentication

Enhancing the security of your online accounts goes beyond creating a strong password; it involves the implementation of multi-layered or two-factor authentication. This essential security feature adds an extra layer of protection by requiring an automated message or phone call to verify your identity with a unique code. By activating this feature, you make it significantly more difficult for hackers or identity thieves to gain unauthorized access to your account. To enjoy the benefits of multi-layered authentication, simply request your bank or credit union to set it up for you.

Secure Surfing: Avoiding Risks on Public Wi-Fi

According to a recent news report from NortonLifeLock Inc., researchers have discovered significant security risks associated with public Wi-Fi usage. These risks encompass the potential for hackers to engage in electronic eavesdropping, the exposure of sensitive activities like online banking, transmission of data over unencrypted networks, the presence of malicious hotspots, as well as the infiltration of malware and spyware. Consequently, it becomes crucial for users to exercise caution when connecting to public Wi-Fi networks and undertake necessary measures to safeguard their sensitive information

Think Before You Share Personal Information

Do you practice caution when sharing personal information online?

Exercising caution is of utmost importance when disclosing your banking or sensitive information to anyone. Scammers frequently adopt false identities to acquire personal and financial details from unsuspecting individuals. Should you encounter such a situation, take immediate action to terminate the conversation and promptly notify your bank if you have doubts about the authenticity of the person requesting your information. Always prioritize the security of your information and remain vigilant against potential scams.

Stay Informed: Subscribe to Banking Alerts

Stay informed and collaborate effectively with your bank by utilizing alerts that keep you updated on all activities occurring within your bank accounts. In case of any suspected fraudulent or suspicious activity, it is crucial to report it promptly to your bank. If you receive a notification regarding such activity, we strongly advise you to contact your bank immediately to initiate the process of resetting your online banking passwords..

Always Consider Top Reliable Financial Apps

Ensure the security of your personal and financial information online by exclusively accessing reputable websites and mobile applications. Sharing sensitive details on deceptive websites can lead to scams and identity theft. Take proactive steps to verify the legitimacy of the source before installing any programs, especially from trusted platforms like the App Store or Google Play. Scrutinize developer information and user reviews to ensure authenticity. Additionally, it is recommended to evaluate the security protocols and application ratings before utilizing them for your transactions. Safeguard your data with vigilance and thorough assessment.