Inflation is a critical issue that impacts long-term financial objectives

With rising inflation and uncertain future costs of living, it's more challenging to save for retirement.

The Greenwald Research's Retirement Confidence Survey revealed that concern about retirement are increasing among Americans. This shift in mindset towards retirement planning reflects the growing realisation of the challenges ahead.

The rapid spread of inflation is eroding the future value of money. Saving for retirement becomes increasingly difficult due to diminishing purchasing power. Addressing retirement planning and finding strategies to combat the effects of inflation is crucial.

Inflation poses a silent threat to retirement savings

Global inflation is predicted to reach 6.6% in 2023, according to the International Monetary Fund, posing a significant risk to financial stability.

This poses challenges in managing savings, mortgages, future planning, and debt, making it crucial to rely on retirement savings for financial stability.

Retirement planning and anxiety are heightened by rising prices. Even for people with the best-laid plans, inflation is still an uncontrollable factor, making it an enemy of fixed incomes.

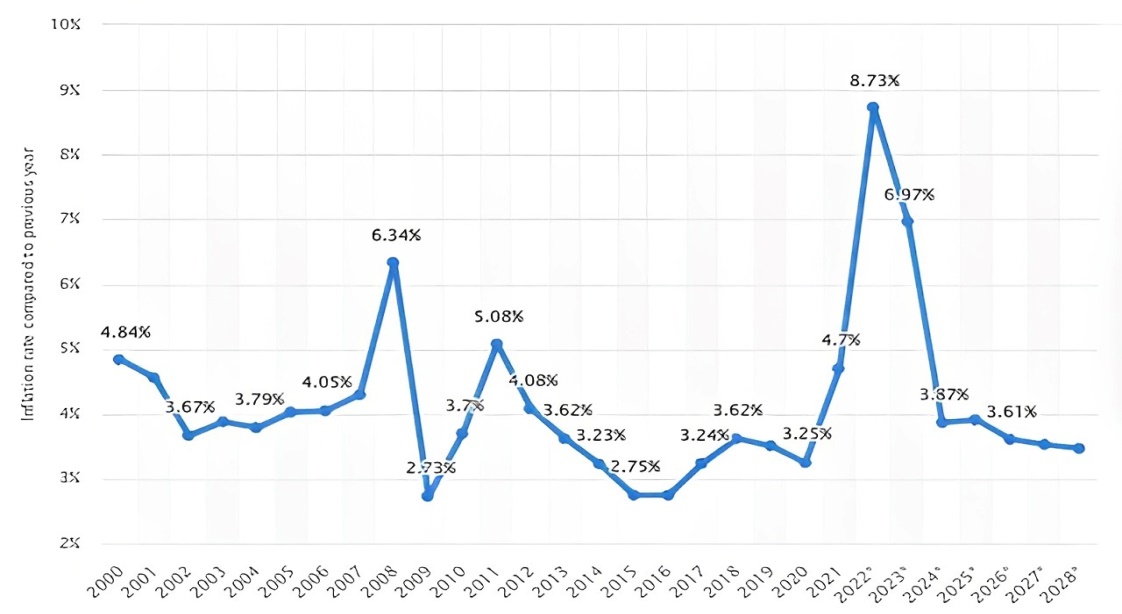

Inflation is expected to hit 6.97% in 2023

Figure 1: Global inflation rate from 2000 to 2023, with projections until 2028

Source: Statista

According to the Federal Reserve, 25% of Americans lack retirement savings, and two-thirds worry about achieving retirement savings objective. The Federal Reserve added that a 2% inflation rate creates an ideal economic environment. To safeguard your retirement savings, it is crucial to grow funds at the same pace as rising inflation.

Assuming an inflation rate of 3%, the cost of goods and services is projected to increase by 3% annually. To maintain purchasing power, a minimum return of 3% on investments each year is required.

The amount needed for retirement savings depends on personal income and lifestyle preferences. No one-size-fits-all answer exists.

If a person does not earn enough on investments, his retirement savings will lose value over time. For example, if one person earns 1% on investments, the value of $100,000 will drop to $81,649 in 20 years.

To secure funds for the future, it’s essential to maintain savings growth that matches or exceeds the inflation rate, preserving purchasing power and ensuring a stable financial future.

Diversify investments, rebalance portfolios regularly, and maintain disciplined investment strategy for long-term financial goals

To outpace inflation, invest in assets with growth potential, such as stocks, real estate, and commodities. These assets can grow at a rate higher than inflation, safeguarding investment value.

As retirement approaches, consider adding fixed-income assets, like inflation-protected bonds issued by the U.S. Treasury, such as Treasury Inflation-Protected Securities (TIPS). Bonds offer a level of protection against inflation, ensuring investments maintain value.

Diversifying retirement portfolio can involve investing in commodities such as oil, gas, or precious metals like gold and silver. However, be cautious, as commodities can be volatile, and allocate just a small portion to them. Nonetheless, during inflation, commodities can perform well, as prices tend to rise due to limited supply.

Consider market volatility and interest rates for retirement savings

Inflation and market volatility can impact retirement savings making it crucial to maintain a balanced and diversified portfolio, considering multiple factors. Market volatility and changes in interest rates also impact investments.