Older generations might remember the days of manually recording every transaction of their respective bank accounts also known as balancing the checkbook. But now younger generations might not even know what a checkbook is. All the credits go to online and mobile banking services offered these days. The days of meticulously checking and recording your deposits and expenditures are gone.

However, that doesn’t mean you shouldn’t monitor your checking account. If you are concerned about preventing fraud or minimizing fees, then you must check your accounts regularly.

Monitor your checking account

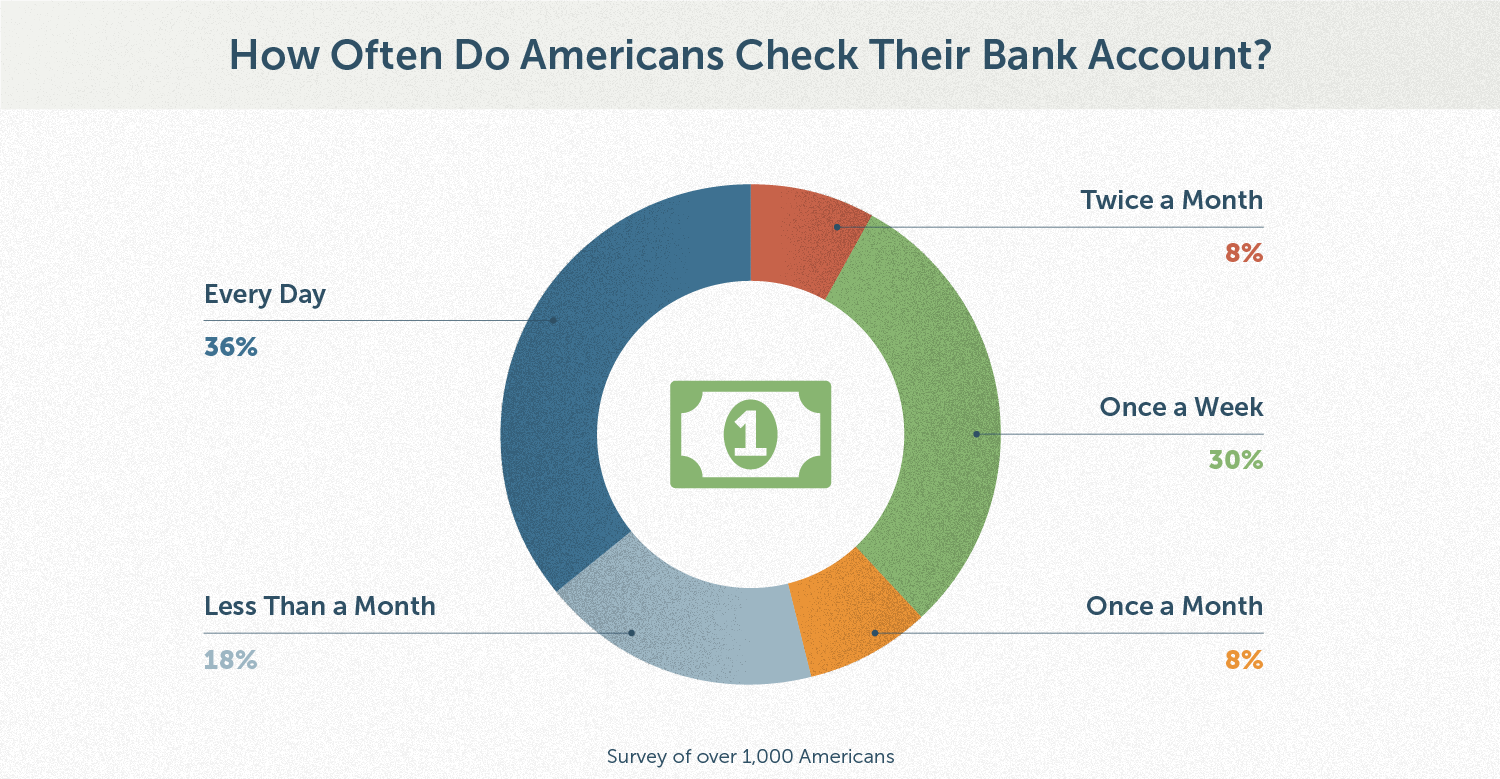

According to a survey by Lexington Law, 36% of Americans said they review checking accounts daily, while 30% check it once a week.

Source- Lexington Law

Experts recommend monitoring your checking account for irregularities and transaction activities once a month. However, there are benefits when you monitor your account on a more frequent basis.

Monitoring your checking account will not only help you adopt a healthy financial habit but it can save you thousands of dollars as well, in the event of theft or fraud.

According to Citizens National Bank, "Account holders should aim to review their purchases once or twice a week but they should never wait more than a month to check their accounts."

In terms of how often you should monitor your account, the answer is completely personal. Still, it is safe to say that checking it once a month isn’t enough if you want to minimize your losses and stay on top of your finances.

If you live paycheck-to-paycheck, you might need to check your accounts more frequently. This also works for people who receive paychecks from multiple sources (freelancers or self-employed).

If you aren’t used to monitoring your checking account regularly, then you can log into your bank account through online banking once or twice a week. From there you can make a process and start monitoring your account once a day.

For example, you can examine your account activity in the morning or at the end of the day to see which debit or credit transactions have been posted. Through this method, you can keep up with your running balances.

What you should monitor for?

When you are reviewing your checking account activity, the first step you need to take is to look for unknown transactions if there are any. If you find any transaction that is not made by you, immediately report it to your bank.

After looking for unidentified transactions, look for any deposits or payments you have posted or the recent purchases you made. With all this being followed, finally, you need to look through your accounts to see which fees, if any, have been charged by your bank.

On a monthly basis, monitor your personal information including email and phone number so that those things are up to date. You can also change your mobile and banking password every three to four months if you want. Choosing a new and unique password regularly will reduce the risks of your account being compromised.

Why is it necessary to monitor your checking account?

Prevent fraud

The most important reason to monitor your checking account is to prevent fraud. Bank or card frauds have increased rapidly in today’s world. The only two real defenses against it are to be extremely cagey with your financial details and to constantly monitor your checking accounts.

In the event of theft or fraud, the Electronic Fund Transfer Act protects your funds. Under this act, if you report a debit card stolen or lost, you aren’t responsible for any transactions that follow.

But if someone makes a transaction before you report about the card, then the charges will be borne by you.

The chart below highlights how much you are liable for based on when you report a theft or fraud:

| The time period of reporting theft or fraud | Maximum loss |

| Before any unauthorized charges are made. | $0 |

| Within two business days after you notice the loss or theft | $50 |

| More than two days after you report about it, but it should be less than 60 calendar days after your statement is sent to you. | $500 |

| More than 60 days after your statement is sent to you | All the money is taken away from your checking account and from linked accounts. |

Monitoring your checking accounts regularly will help notice and report your problems as soon as possible. Try to check your accounts daily so that you can limit your responsibility in case of any unauthorized transactions.

Identify hidden charges

Frequent checking of bank account will help you notice if there are hidden charges or not as banks can be sneaky when it comes to making money. So it is obvious that they might charge you some fee which makes no sense. Knowing about when it happened can’t stop these fees but if you examine your account regularly, you can notice the hidden fee and talk to your bank about it. They might not withdraw it but at least they will guide you on how to avoid these charges in the future.

If you go through your account regularly, you will notice some of these common fees that include:

You might not be aware of the costs of some of these but you are not alone as these charges are hidden on your account so that consumers pay for them unnoticed.

However, if you encounter any unexpected fees or feel like you are overcharged, you can talk to your bank and ask them to withdraw the charges. Otherwise, you can even decide to switch accounts altogether if checking accounts are costing too much for you.

Better management of your financial life

Overspending is very common these days and most of us are guilty to overspend occasionally. By regularly monitoring your checking account, you can ensure that those occasional overspendings don’t harm your pockets much. When you monitor your account, you get aware of what you are spending and where you are spending.

If you have awareness of your expenses, you can keep them in control and have a better hand on your finances.

You can easily plan your budget and determine where you need to cut your expenses. Having an idea of exactly what you have in your account at all times will also reduce the risk of running into your overdraft and getting a fee.