Numerous banks are still saddled with rigid and core legacy fundamental systems which limit the delivery of optimal customer experience. Large banks and institutions must adopt emerging technologies to stay relevant in a competitive market.

Cloud migration and automation are playing a key role in the bank’s efforts to modernise and it will continue to do so over the next decade.

Transition to digital

Banks with integrated cloud migration process their activities more efficiently and have reported cost reductions, improved employee experience and built-in automation skills leading to a shorter time to market.

Digital transitions are highly complex operations. Only a few of the senior banking and capital market executives strongly support modernisation in their organisations, as it demands strong, long-term support from the banking and financial institutions’ leadership teams and deep alignment throughout the company.

The number of competitors is sharply increasing as tech-savvy, client-based fintech has exponentially grown over the last decade. UK’s fintech market represents 10% of the global market valued at around GBP 11 billion ($13.2 billion).

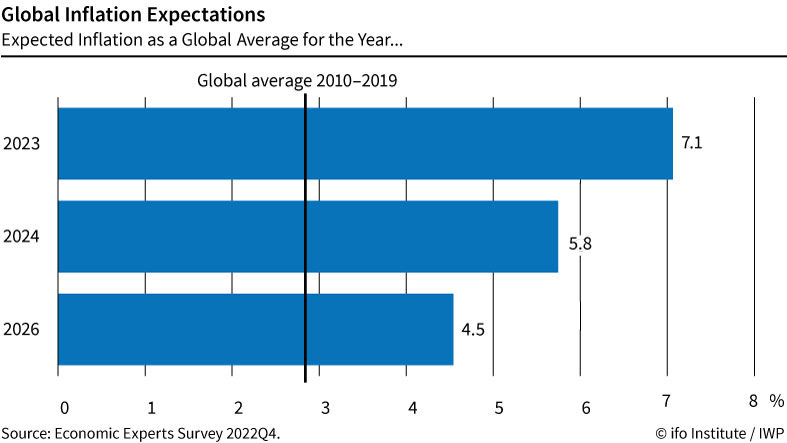

Based on a comprehensive study by the World Bank, the world may be edging toward a global recession in 2023 and a string of financial crises in emerging markets and developing economies would do a lasting detriment, as central banks across the world simultaneously hike interest rates in response to inflation.

According to the survey by Economist Impact commissioned by Cognizant, the banks, asset managers and financial intermediaries need to modernise to become future-ready urgently. The sector is still suffering from the 2008-2009 financial crises, which led to strict regulation of its activities and reputational damage that many businesses haven’t managed to shake off.

Migration to customised microservices

Bank must move towards deploying a modular and flexible middle layer that acts as the digital core to create a truly open ecosystem. Integrating IT in the core functionality could transit into microservices and then decommissions the rest.

By prioritising capabilities to support newly designed customer journeys, banks will relish a typical reduction of 15% in cost and 10% in time. Modernising the account management system by migrating functionalities, such as interest rate calculations and account naming, enable the banks to pursue a digital journey.

Prioritise integration over system simplification

Focusing first on integration and subsequent simplification is the conventional strategy to reduce complexity by rationalising systems and applications. Banks must enforce mechanisms to decommission redundant systems, simplify their product set, and boost technological proficiency, particularly in cloud computing, ecosystems based on application programming interfaces (APIs), and automation in general to modernise legacy systems.

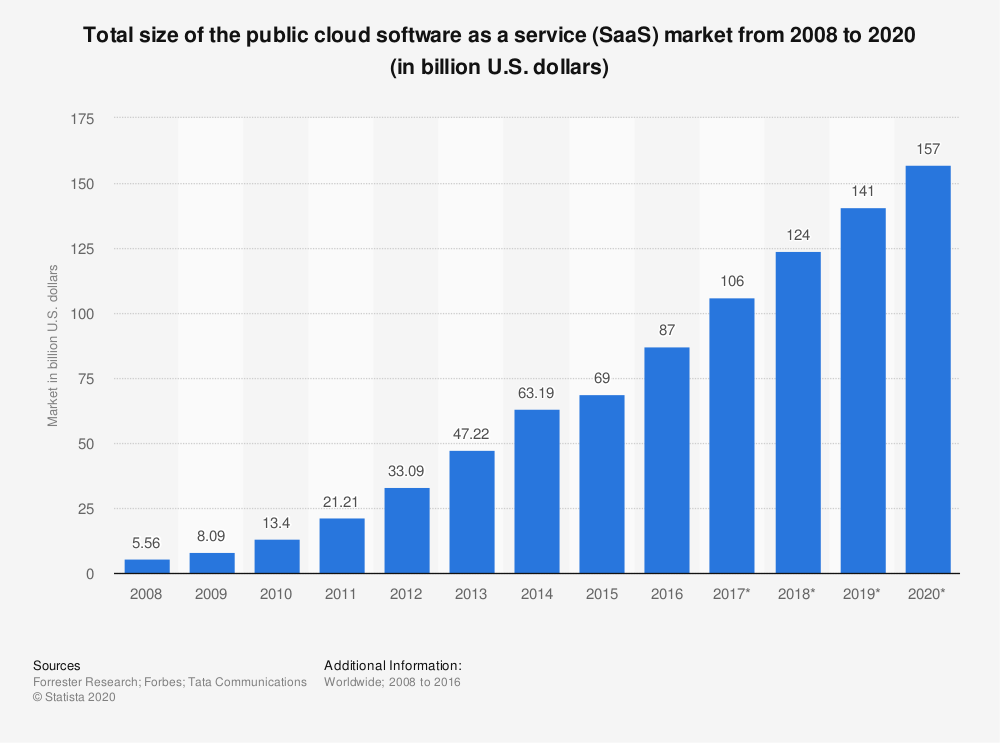

Total size of the Public Cloud Software as a Service (SaaS) market from 2008 to 2020

Moving all non-differentiating functions to SaaS

The Software as a service (SaaS) model provides core banking software, which is deployed on the service provider’s side and the client accesses it through a web browser.

Don Ginsel, director of Holland FinTech said the core legacy systems used by traditional banks were not working with other systems, which is certainly not the case with SaaS. Most successful firms have a good sense of function which they can combine to create a competitive advantage. This migration will further benefit cloud add-ons, which boost productivity, hence reducing time and cost by 10%.

To ensure that the banking and financial sector is ready for modernisation, they need to eradicate the core legacy operating models and invest in innovations like artificial intelligence (AI), machine learning and the internet of things (IoT) to maximise their IT architecture and be ready for the future.