From our Bloggers

Credit Union vs Banks! Which one should you choose?

- Posted on August 18, 2020

- 1999 Views

- Print

- Download

-

- Share

By Karan Kapoor

You have to store your hard-earned money somewhere, one cannot simply stash it all in your home. When it comes to this choice, you have two options for yourself to choose from. Credit Union or Bank.

Many consumers are turning towards Credit Unions, because of the Bank's rising fees and uncertain rules and regulations. A lot of people turn towards Banks from Credit Unions because of their high rate of interest.

When deciding what to choose, there are so many parameters to think of. Parameters can be depending on yourself and also the financial institutions. Sometimes the financially versed get confused about what to choose.

What is a Credit Union?

It is a financial institution, similar to the concept of cooperative societies. They provide traditional banking to people who are a member of it. It ranges from small size to large corporations. It receives deposits and provides loans to its members.

What is a Bank?

It is a financial institution, that is licensed by the government, and allowed to receive deposits and give away loans.

Difference between Credit Union and Banks

The main and the basic difference amongst the two is, Banks are for-profit and Credit unions are not-for-profit.

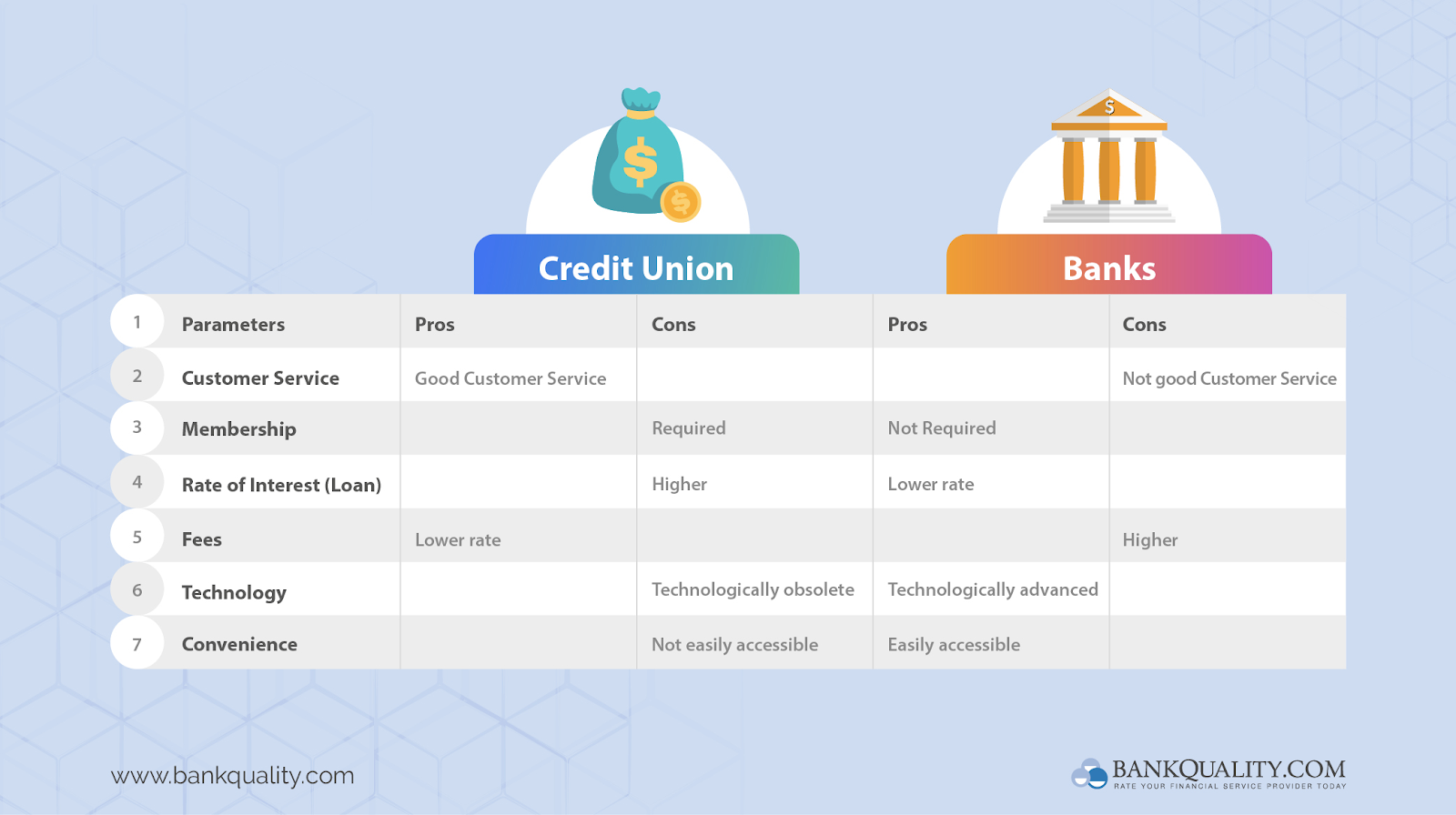

Credit unions are known to have better customer service, and lesser fees, yet higher interest rates. The Banks, have higher fees, convenient locations, are technologically advanced and, have a lower rate of interests.

In a report by Credit Union National Association (CUNA), credit unions situated in New York, at an average provide financial benefits equivalent to $85 per person(member) and $178 per house, in 12 months, ending March 2018.

Credit Unions still provide better customer services, even though Bank is easily accessible.

Even with such reports, Credit Unions are unable to create a monopoly over the premium customer service. Smaller Banks sometimes provide better service to Credit unions.

Both provide similar service, savings account, loans, checking, business accounts, and so on. The point to be noted is, despite some variance, the service and products both offers are the same

Let’s put a light over the Pros and Cons.

The questions that you need to ask yourself would be Why?

Why the Credit Union?

Why Bank?

These were the pre-requisite knowledge, before deciding what to choose.

Let's check some more things such as CD Rates, Loans, Mortgages that the Credit Union offers.

-

Certificate of Deposit(CD) - Pentagon Federal Credit Union (June 2018) 12 months term is 2.25%. Marcus by Goldman Sachs 12-month term 2.3%.

-

Loan interest rates - The loan interest rates differ from Credit Union to Credit Union, it can range from 6.49% on small loans to as high as 27% on larger loans,

-

Mortgages - Credit Union can offer mortgages, even with a very low credit score.

The tussle between Credit Union and Banks is there, but you are the person to decide what you want to choose. What are your requirements?

If you are a daily money user, and make a lot of online payments or transfers or use digital wallets, Banks should be your destination.

If you require simple banking with fewer interests, yet more customer satisfaction, then Credit Union is your place.

You have to ask yourself.

Further Readings...