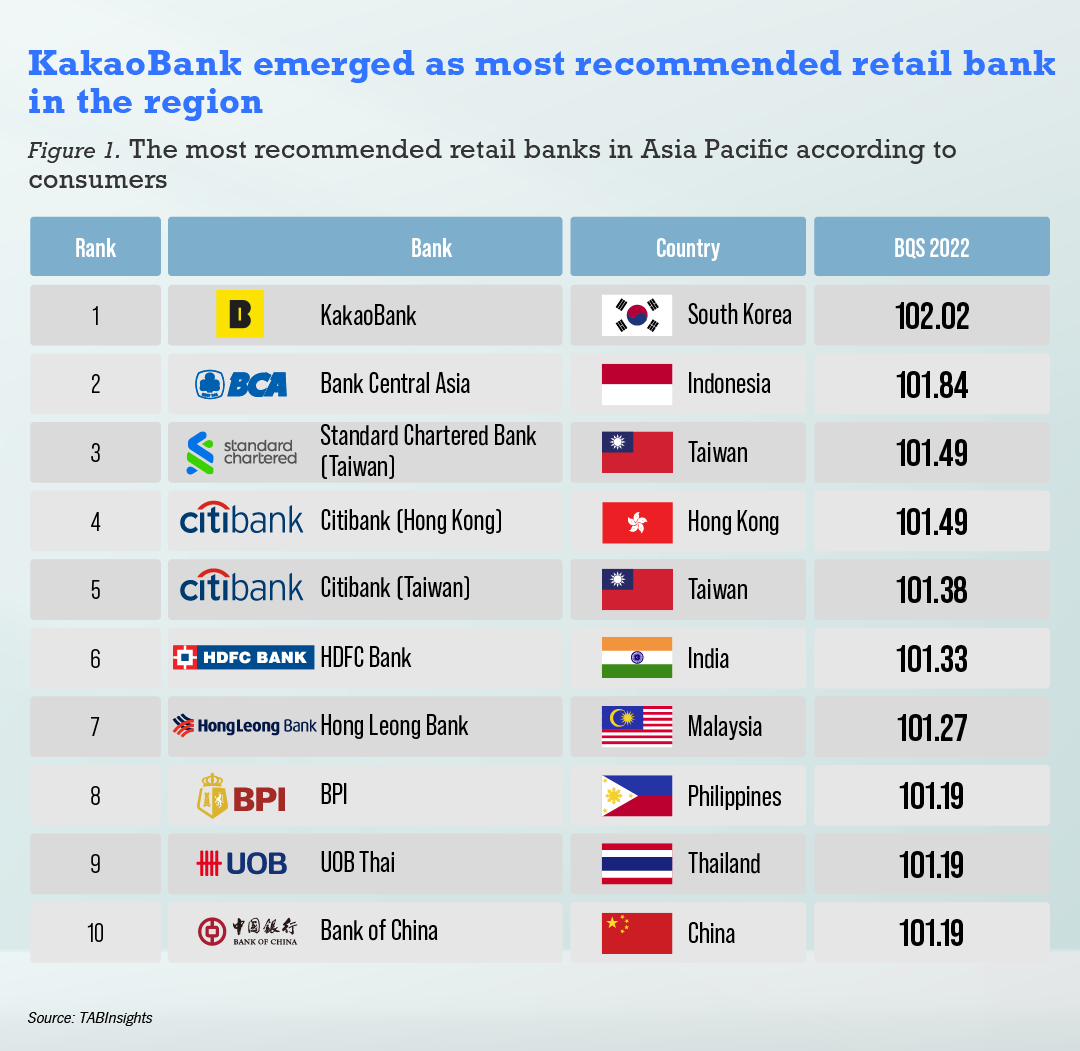

South Korea’s kakaobank is the most recommended retail bank in Asia Pacific in 2022, the second time that the standalone digital bank has topped the BankQuality Consumer Survey and Retail Bank Rankings in the last three year.

Customers who strongly recommended their main retail banks in this year’s BankQuality Consumer Survey, did so because of the convenience in online account registration, zero-fee transactions, fast fund transfers, personalised products, sophisticated mobile app user interface, and the sense of security they have with their banks.

Banks started to reevaluate their business models to adapt to changing customer behaviour and experience with the emergence of fintech firms that have challenged incumbent banks. Kakaobank which hailed as the most recommended retail bank in Asia Pacific, cemented its popularity as a digital bank thanks to digital-savvy users and seamless banking experience. The digital bank disrupted the traditional banking landscape in South Korea with deepened customer-centric approach that focuses on convenience that helped them to become one of the fastest growing banks in the world. Bank Central Asia of Indonesia which ranked second, introduced its own digital-only bank called Blu in 2021. The bank reported a total transaction volume growth of 42% year-on-year (YoY), particularly driven by a 60% YoY increase in mobile transactions.

In the past year, banks have emphasised customer data as a catalyst to ensure their products and offerings add value to the customer journey. As technology advances, consumers are increasingly expecting a service experience more personalised their individual requirements. Data driven personalisation becomes an imperative for banks, enabling them to respond to customers’ manifest and latent needs.

More banks are starting to leverage service and product personalisation to differentiate their brands, boost financial performance, and improve customer experience. Banks that are able to rapidly deliver personalised products and services have created significant advantage among their peers.

The emergence of fintechs have pressured banks to accelerate their digital transformation journeys. Some banks have collaborated with these fintech players to develop and launch innovative products and offerings. In the past years, we have seen the emergence of new embedded financial services such as, buy now, pay later (BNPL), and third-party collaboration through the use of open application programming interfaces (APIs). These have helped to vastly increase the efficiency, convenience, and agility of players in this evolving banking landscape. Some incumbent banks have also introduced digital-only subsidiaries to compete with the new challenger or neo banks

Nevertheless, banks continue to face challenges in executing this data driven customer-centric strategy, especially in the area of data analytics to leverage their vast customer databases. Also, cybersecurity concerns and banks’ ability to effectively thwart attacks and mitigate digital threats will be crucial to win customer trust.

Personalised and agile digital services dictate strong customer engagement

South Korea’s largest digital-only bank kakaobank was voted by consumers as the most recommended retail bank in Asia Pacific. Out of over 300 banks, kakaobank is the only digital bank that made to the top twice in the rankings in the year 2020 and 2022. The digital bank emerged as the most recommended retail bank in the region with an overall BankQuality score (BQS) of 102.02, surpassing traditional counterparts in the region. Rounding up the top five most recommended retail banks in the region are: Bank Central Asia of Indonesia, Standard Chartered Bank (Taiwan), Citibank (Hong Kong), and Citibank (Taiwan).

To view the full ranking, visit https://www.bankquality.com/global-rankings/most-recommended-retail-banks-in-asia-pacific

While kakaobank is merely in operation for four years since it was publicly launched in 2017, it has already overtaken established competitors with the size of its user base and transaction volume. The bank cemented its popularity as a digital bank thanks to mobile-savvy customers and around-the-clock service and convenience. The bank surpassed the 18 million users mark at the end of 2021.

The bank grew its operating income by 109.6% year-on-year (YoY) accounting to $204.8 million (KRW 256.9 billion) and net profit growth of 79.7% to $162.7 million (KRW204.1 billion). The expansion of interest income due to loan growth contributed to the strengthening of the profitability. The total deposits grew by 28% YoY to $23.9 billion.

In July 2021, Bank Central Asia introduced a digital-only bank called Blu. It acquired a local lender, Bank Royal, in 2019 for $68.6 million and transformed it into a standalone digital brand, Blu, that targets the digitally savvy millennials. Prior to its launch, several other commercial banks have also introduced their own digital banking offerings in Indonesia such as Jenius by Bank BTPN, Digibank by DBS, TMRW by UOB, and Bank Raya by BRI.

Blu introduced the bluAccount designed for financial budgeting and planning with up 10 different bluSaving accounts. The function enables users to separate their savings and expenditures based on their individual needs. It also offers bluGether that enables users to pool their saving accounts just like a treasury pooling liquidity management account, and bluDeposit for easier deposit top-up. The mobile app will touch the bank’s existing customer base of 29 million. In 2021, BCA reported a total transaction volume growth of 42% YoY, particularly driven by a 60% YoY increase in mobile banking transactions.

Rankings reflect the true voice of consumers

South Korea had not seen new players in the banking landscape for over 25 years before kakaobank officially launched its service in the public 2017. The big banks did not fully focus on mobile banking either. The digital bank reinvented the wheel of the banking service in the country. Kakaobank registered 240,000 users within ten days from its launch, more than what the entire commercial banking industry acquires in a year. Its first day of operations saw more than 300,000 loan account applications that overwhelmed its system, but the bank was able to immediately scale up since then.

Digital disruption has blurred the lines across most industries and the banking sector is no exception. Kakaobank’s customer centric approach to revisit banking with a differentiated experience and a focus on convenience has helped it become one of the fastest-growing banks in the world.

The digital bank has been able to save on costs by offering its banking services only on mobile compared to traditional banks counterpart. These cost-saving strategy have been passed on consumers through zero-fee transactions, lower loan rates and remittance fee. It is a fact that most consumers are value driven, hence, pricing is one of the key reasons why the digital bank have been able to attract customers.

Kakaobank provided convenient and seamless banking services in a way that consumers can easily make zero-fee funds transfer through Kakao messaging apps without the hassle of one-time password but only requires fingerprint certification procedure. It also integrated the Kakao’s existing brand equity as it has the main characters from the emoticons plastered across their check cards, which offer free withdrawals from any banks.

The digital bank’s customer onboarding has been compared to opening an account on social media as it implements electronic know your customer (eKYC) that enables customers open an account in less than 10 minutes. The consumers who answered the BankQuality survey said they love the convenience and efficiency of the digital bank’s services.

Customer journey mapping provides exceptional user experience

DBS Bank, together with its community banking brand POSB, is the most selected main retail bank in Asia Pacific.

To view the full ranking, visit: https://www.bankquality.com/global-rankings/main-retail-banks-in-asia-pacific

Rounding up the top five most selected main retail banks in Asia Pacific are Maybank of Malaysia, BDO of the Philippines, Bank Central Asia of Indonesia, and ICBC of China.

Customers praised DBS’ seamless and convenient banking transaction on its mobile app. “Easy to use and stable”, “offers wide range of products”, “convenient”, “fast online banking”, “many bank branches”, and “very innovative bank” are the common comments made by the consumers.

DBS leveraged customer journey mapping to become a more customer-centric financial institution. The bank harnessed the power of data analytics to understand customer behaviour and leverage digital channels to provide a more personalised customer experience. For example, the bank uses analytical models to predict the potential increase in traffic at branches to ensure consistent customer experience.

Furthermore, by predicting the customers who are more likely to use digital channels, the bank was able to proactively engage them at the start of their digital journey. DBS’ net profit reached $5.02 billion (SGD 6.80 billion) in 2021, up 44%. Loans grew by 9%, the highest since 2014.

Navigating the post-pandemic landscape

The COVID-19 pandemic has reshaped the financial industry and affected customer behaviour. Consumers were forced to rely on remote and contactless banking services. Fintech players and neo banks also started to emerge to provide alternatives to the traditional banks.

More products and services are now designed around convenience and personalisation. Most banks leveraged their digital capabilities to provide easy-to-use mobile apps centred on lifestyle services and financial products that are tailored for different segments of customers.

About the BankQuality Consumer Survey and Rankings 2022 Survey Methodology

The BankQuality™ Consumer Survey and Rankings interviewed 11,000 bank customers in 11 markets across the Asia Pacific region on their engagement, experience and satisfaction with their main retail banks.

The BankQuality™ Score (BQS) is derived from the normalised net promoter score (NPS) of “main bank” institutions to a uniform scale of 0 to 1. A standardised z-score is then calculated from the normalised score, with mean set to 100, so that comparison can be made across markets. The final ranking excludes banks that achieved less than 30 “main bank” responses.