Over 90% of organizations worldwide have migrated to the cloud, and banking and financial services spend over $67 billion annually on cloud services, with their overall IT expenditure steadily increasing, as customers generate 2.5 quintillion bytes of data every day.

The reliance of industries on cloud computing to monitor their diverse data and operational needs has led to a projected market size of over 1 trillion dollars by 2028. The benefits of cloud services are widely recognized and understood by all industries, including banks and financial institutions, who are now actively seeking to migrate to this latest technology.

In this digital age, where UPI has revolutionized the payment industry with its rapid money transfer services and other paid features, cloud computing has emerged as an integral future of payment services. It offers significant advantages such as time savings, increased processing power, and fulfilment of many monetary requirements of banks.

To enhance customer satisfaction, banks and financial institutions are making substantial investments to integrate cloud computing services into their payment processes.

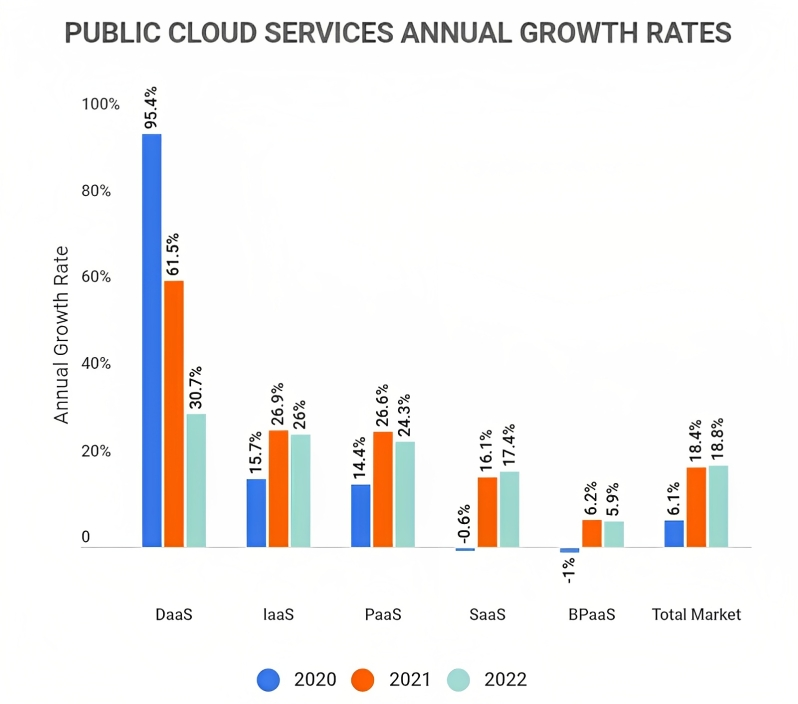

Public Cloud Services Annual Growth Rates

(Source: - Zippa)

What are Cloud based payments?

The adoption of cloud technology has significantly streamlined the payment service, providing users with a convenient and flexible solution. With robust internet connectivity, user data can be stored securely in cloud servers, easily accessible from anywhere. Furthermore, cloud technology enables companies to take a modular approach to their business, facilitating quick and efficient changes to improve time to market.

Advantages of cloud migration

Cloud Payments and Bank

The implementation of cloud payment by a vast majority of banks can be viewed as a proactive measure that adds significant value to essential services, consequently enhancing the end-to-end payment experience in real time. The migration of banks to the cloud has facilitated their ability to adapt to the notable surge in payment volume, which has been a result of the COVID-19 pandemic, thereby significantly impacting the banking industry.

So, Is Cloud Payment the Future of Banking?

Cloud payments present numerous benefits that go beyond their flexible and seamless payment capabilities. These advantages can foster the transformation of banks post-migration process.

The cloud offers robust security with servers across multiple geographies, providing a reliable disaster recovery and management solution for banks. With its efficient backup system, lost data retrieval is simplified, enabling banks to equip appropriate resources and streamline the process.

Cloud integration offers a multitude of connections between environments, effectively breaking down silos and improving visibility to create more streamlined business processes.

The cloud has bridged the gap between speed and seamlessness in digital transformation, enabling payment software to be installed on even the most basic hardware or without any hardware at all.

Banks can introduce new services to the market at an outstanding pace due to the advanced data analytics and integration capabilities of cloud technology. The integration of supply chain, inventory, and data management processes into a single system enhances operational efficiency and supports innovation.

Conclusion

Cloud-based payment systems offer a flexible architecture and advanced technology that enables continuous improvement in meeting consumer demands. With its ability to optimize capital expenditure and facilitate seamless payment processes, cloud technology presents a valuable opportunity for businesses to enhance profitability. Therefore, increased adoption of cloud-based payment services is crucial for banks to remain competitive and thrive in the payments landscape.